Our latest update brings performance and security improvements.

Did you know?

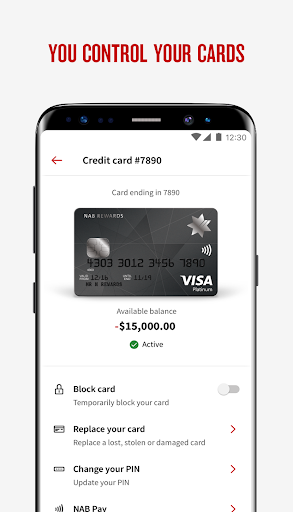

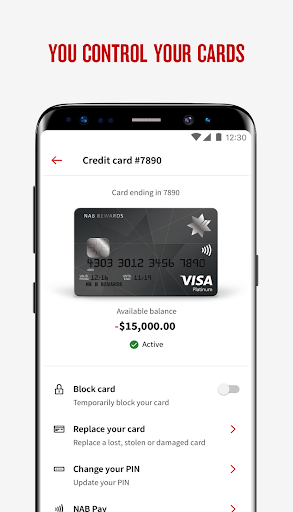

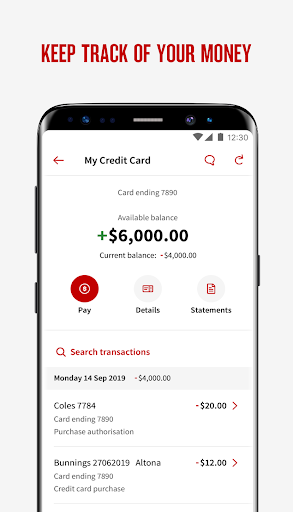

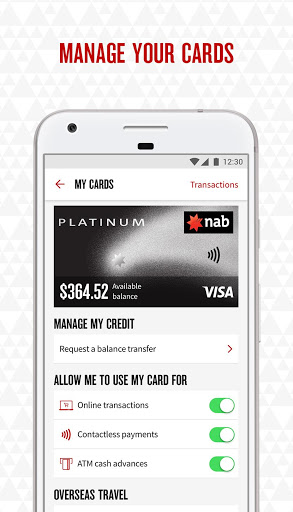

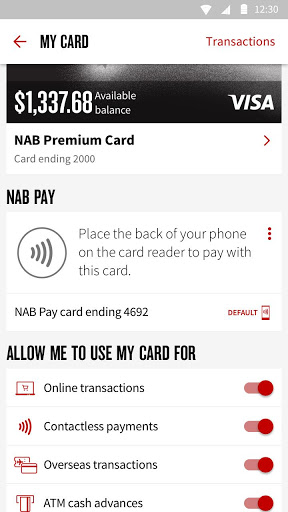

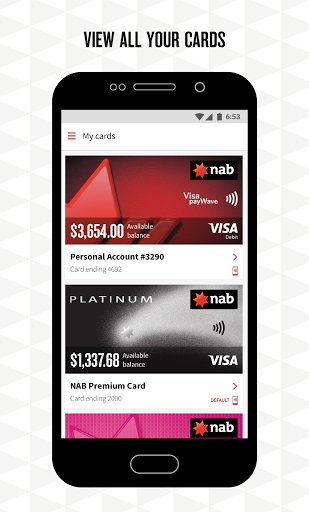

You can access your card details in the NAB app. Save time and copy and paste them when paying online.

We've made a few changes to the app:

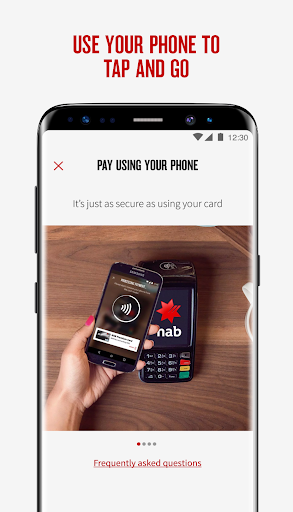

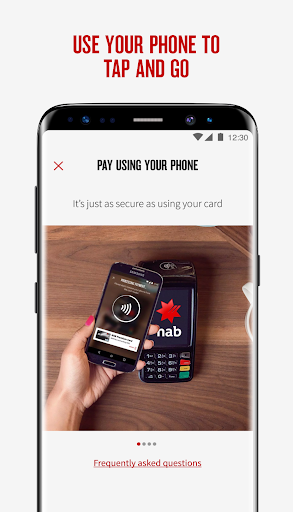

• Simply and securely set up Google Pay directly from the app, removing the need to manually enter in your card details.

• Fixed an issue where some new feature badges would not dismiss properly.

• General performance and stability improvements.

Please remember:

Keeping your phone's operating system up to date is important, as new versions can include important security updates and improvements.

We've made a few changes to the app:

• General performance and stability improvements.

Please remember:

Keeping your phone's operating system up to date is important, as new versions can include important security updates and improvements.

We've made a few changes to the app:

• General performance and stability improvements.

Did you know?

Waiting for some money to hit your account? Why not create a payment notification, so we can tell you when it arrives, and you don't have to keep opening the app to check your account? Just tap on Settings > Notifications to set them up.

- General performance, stability and security improvements.

Did you know?

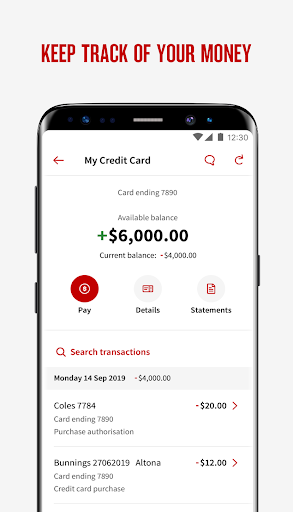

You can access your statements from the NAB App? Whether you're preparing for your tax return or want to send them to your accountant. Tap on the account you'd like to see, then tap on Statements.

We've made a few changes to the app:

• General performance and stability improvements.

Reminder: NAB Pay is no longer available for Tap and Pay. To find out more about other alternative digital payment services, visit https://nab.com.au/nabpay

We've made a few changes to the app:

- General performance, stability and security improvements.

Did you know?

Do you have a preferred method to log into your NAB App? Whether it's with a password, passcode or biometrics, you can set up your app the way you like it, just head over to Settings > Security.

We've made a few changes to the app:

• General performance, stability and accessibility improvements.

Please remember:

If you update the biometrics or add a new fingerprint to your phone, for your security, we'll need you to log in with your password or passcode again before you can turn it back on.

Some customers may have noticed the latest version of the app crashing occasionally after using NAB Pay. We've fixed that in version 9.91.2 of the NAB App.

In case you missed it, version 9.91.0 and 9.91.2 will also include:

• General performance, stability and accessibility improvements.

Did you know?

Do you have a preferred method to log into your NAB App? Whether it's with a password, passcode or biometrics, you can set up your app the way you like it, just head over to Settings > Security

We've made a few changes to the app:

• General performance, stability and accessibility improvements.

We've made a few changes to the app:

• General performance, stability and accessibility improvements.

We've made a few changes to the app:

• Need help depositing into your account? We've added a Make a deposit guide to the Account Details screen.

• General performance, security, stability and accessibility improvements.

Please remember:

Keeping your phone's operating system up to date is important, as new versions can include important security updates and improvements.

We've made a few changes to the app:

• Improved data quality for our Branch and ATM location finder.

• General performance, stability and accessibility improvements.

Did you know?

You can access your statements from the NAB App? Whether you're preparing your tax return or want to send them to your accountant. Tap on the account you'd like to see, then tap on Statements.

We've made a few changes to the app:

• Book a home loan appointment at your local branch or with a mobile banker.

• Moved recently and forgot to update your address? When you need a new card, you can change your address to make sure your card arrives at your new address.

• Check and manage your open banking and data sharing permissions.

• Improved stability as we've squashed some bugs and fixed a few crashes.

• General performance and accessibility improvements.

Some customers may have noticed the latest version of the app crashing occasionally when making a payment with NAB Pay. We've fixed that in version 9.74.1 of the NAB App.

We've made a few changes to the app:

• We've updated the transaction history for transaction, savings and goal accounts.

• Improved biometrics stability for when you log in with facial recognition or your fingerprint.

• Fixed an issue where your NAB Id sometimes would not load properly on the My Details screen.

• Improved stability as we've squashed some bugs and fixed a few crashes.

• General performance and accessibility improvements.

We've made a few changes to the app:

• Improved stability as we've squashed some bugs and fixed a few crashes.

• General performance and accessibility improvements.

We've made a few changes to the app:

• Improved stability as we've squashed some bugs and fixed a few crashes.

• General performance and accessibility improvements.

We've made a few changes to the app:

• Improved stability as we've squashed some bugs and fixed a few crashes.

• General performance and accessibility improvements.

We've made a few changes to the app:

• Improved stability as we've squashed some bugs and fixed a few crashes.

• General performance and accessibility improvements.

We've made a few changes to the app:

• Expanded support for biometrics to enable you to log in with facial recognition or your fingerprint.

• Improved stability as we've squashed some bugs and fixed a few crashes.

• General performance and accessibility improvements.

We've made a few changes to the app:

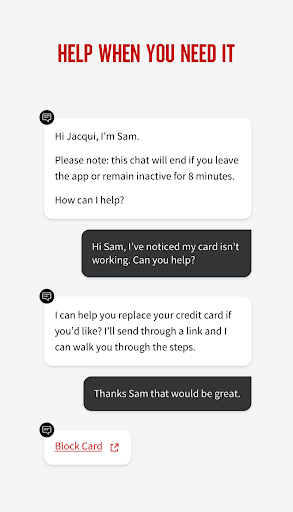

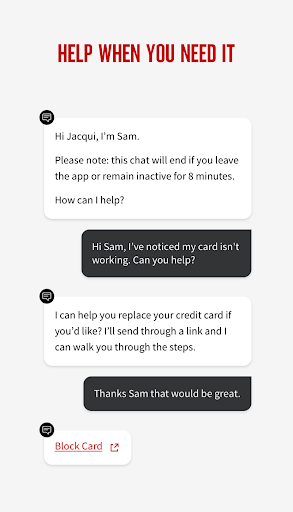

• Get better support and help with chat.

• Interest and Recent Transaction Statements are now available for business customers.

• View your tiered interest information on Business Cash Maximiser accounts.

• Improved stability as we've squashed some bugs and fixed a few crashes.

• General performance and accessibility improvements.

We've made a few changes to the app:

• Your end of financial year interest statement is ready to go.

• See 2 years of statements at a glance.

• View an interim statement for the current month.

• Get proof of your balances in seconds.

• Get better support and help with chat.

• Improved stability as we've squashed some bugs and fixed a few crashes.

• General performance and accessibility improvements.

We've made a few changes to the app:

• We've given the Accounts screen a little makeover.

• Download a summary of your account balances or recent transactions.

• Improved stability as we've squashed some bugs and fixed a few crashes.

• General performance and accessibility improvements.

You talked, we listened. Here’s how we’ve updated the app recently:

• Download a summary of your account balances.

• Improved stability which caused some customers to experience a crash after backgrounding the app, or scanning a cheque.

• General performance, security and accessibility improvements.

You talked, we listened. Here’s how we’ve updated the app recently:

• Further tuning to improve battery performance.

• Improved stability which caused some customers to experience a crash after backgrounding the app, or scanning a cheque.

• General performance and accessibility improvements.

You talked, we listened. Here’s how we’ve updated the app recently:

• Performance tuning to improve battery performance.

• To better protect you, customers who haven't previously updated their default Pay Anyone Daily Limit may be required to input a SMS security code when making a payment.

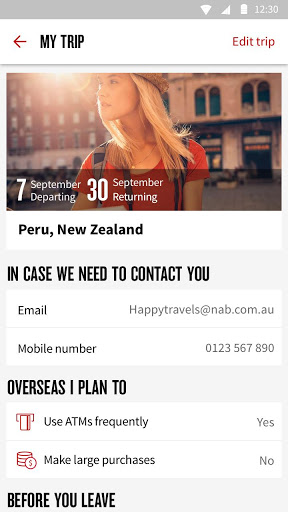

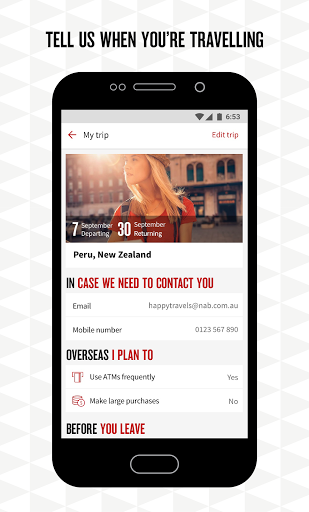

• Find all you need to know about travel in one place, from saving for a holiday, to letting us know about your travel plans.

You talked, we listened. Here’s how we’ve updated the app recently:

• Performance tuning to improve battery performance. Please note, we are continuing to work through these issues and expect further improvements with our upcoming releases.

• View and download your statements for the last 2 years.

• Introducing a new card control, allowing customers the ability to block gambling transactions.

• Monitor and track international payments.

You talked, we listened. Here’s how we’ve updated the app recently:

• Enabled NAB Pay for Android Q.

• Fixed an issue with Quick Balance not loading properly.

• View and download your statements for the last 2 years.

Please note, we are continuing to investigate battery performance issues. We apologise for the delay and inconvenience caused.

You talked, we listened. Here’s how we’ve updated the app recently:

• Edit your direct debits arrangement for your home loan (excluding multi-authority & multi-direct debit arrangements).

• Fixed an issue with profile settings not being recognised when updating to Android Q.

• Fixed an issue with new badges not dismissing.

Please note, we are continuing to investigate battery performance and re-enabling NAB Pay with Android Q. We apologise for the delay and inconvenience caused.

You talked, we listened. Here’s how we’ve updated the app recently:

• Set up notifications when you receive money, are approaching your credit card limit, or exceed your credit card limit.

• Simply scan and store your receipts.

• Scan and deposit cheques, instead of visiting a branch or ATM.

• Further tuning to improve battery performance. Please note, we are continuing to work through these issues and expect more improvements with upcoming releases.

• Security improvements.

You talked, we listened. Here’s how we’ve updated the app:

• Swiping to Quick Balance was sometimes displayed a blank screen

• Improved stability which sometimes caused NAB Pay to stop working

• General performance, stability and security improvements.

You talked, we listened. Here’s how we’ve updated the app:

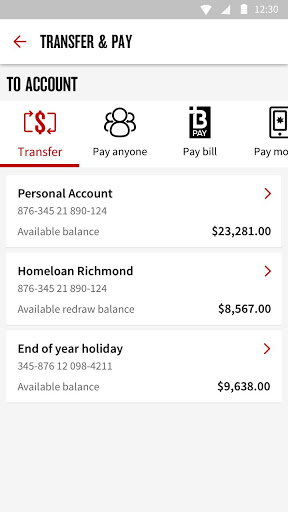

• Fast Payments to BSB and Account numbers that are unsuccessful will be automatically resubmitted and processed in one to two business days.

• Change your credit card limit.

• Receive push notifications when approaching your credit limit on your credit card, or when you receive money into your account.

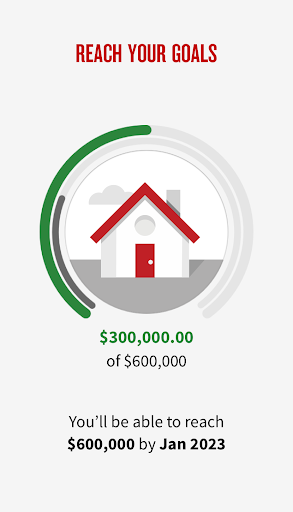

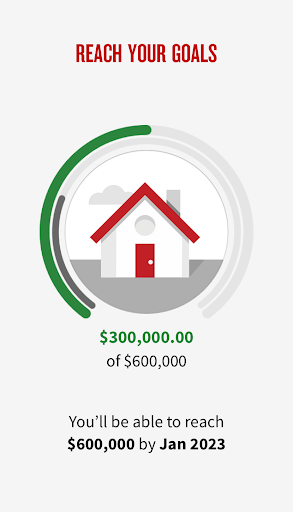

• Set and track savings goals for transaction and savings accounts.

• Performance, stability and Accessibility improvements.

You talked, we listened. Here’s how we’ve updated the app:

• Home loan customers can now see their scheduled direct debits and transfers in the Transaction History screen.

• Some customers using fingerprint were being asked to log in again.

• Some customers were unable to install the app due to a permissions conflict.

• Improved stability while making a payment with NAB Pay or securely connecting to an authorised third party app/service.

• Accessibility improvements.

You talked, we listened. Here’s how we’ve updated the app:

• Improved stability which caused some customers to experience crashes while; navigating through the Settings menu, tapping back on the Transaction History screen, and using some older operating systems.

• Some customers were unable to enter descriptions when making a Pay Anyone payment.

• Some push notifications were not being received by customers.

• Accessibility improvements.

You talked, we listened. Here’s how we’ve updated the app:

• Some customers who successfully logged in with their fingerprint were being asked to log in again.

• Improved stability which caused some customers to experience crashes on the Welcome and My Account screens.

• Customers not already registered for SMS Security can do so in the app to be able to use more features and functionality.

• Accessibility improvements.

• View interest information on iSaver, Reward Saver, Classic and Home Loan Banking accounts in Account Details.

Bug fixes:

• Fingerprint login would sometimes loop when a new fingerprint was added to your device.

• View interest information on Home Loans, iSaver, Reward Saver & Classic Banking accounts.

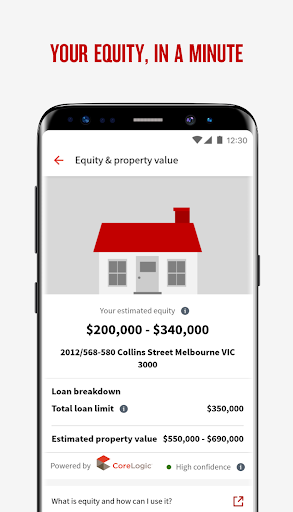

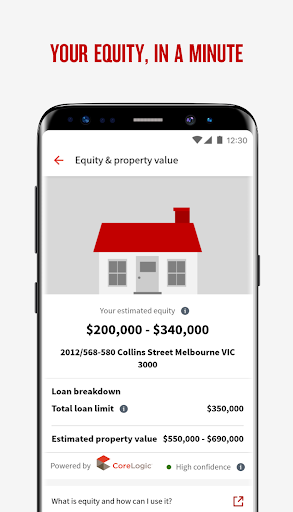

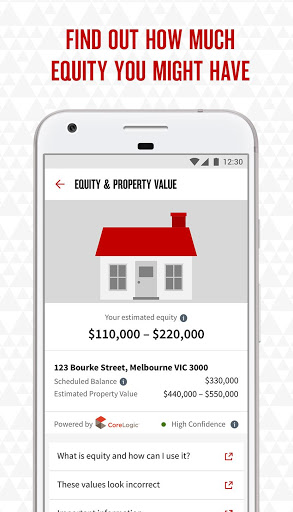

• If you have a NAB Home Loan, add or change your offset account, get an estimated valuation for your property and find out how much equity you might have.

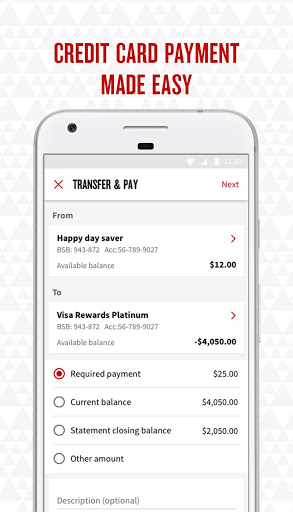

• See how much is due when transferring to NAB Credit Cards.

• See details of your card benefits.

• Rollover your NAB Term Deposit.

• Transactions for Market Rate Facility (Business) accounts.

Bug fixes:

• Accessibility improvements.

• If you have a NAB Home Loan, you can now add or change your offset account.

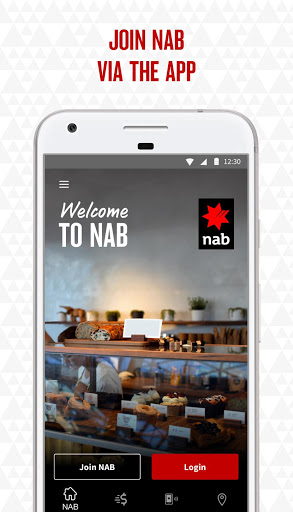

• If you’re new to NAB, you can apply for a NAB transaction or savings account through the app.

Bug fixes:

• Some Accessibility fixes.

• View your credit card statement due date from your transaction history screen.• View and update your tax details for Australia, U.S. and other countries.• Update your addresses and contact numbersBug fixes:• Fixed accessibility issues in the transaction history and Payment confirmation screens.

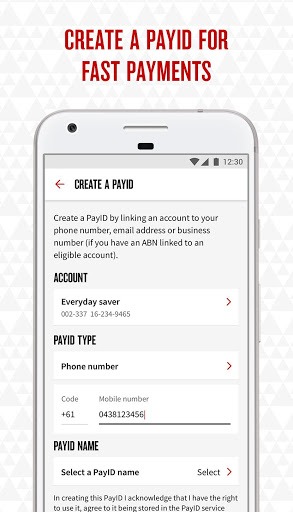

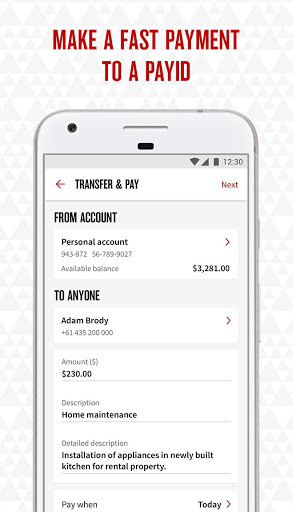

• Make fast payments (also known as NPP payments) with eligible accounts - to PayIDs or BSB and account numbers.• Create PayIDs using your mobile number, email address or business number (ABN).• Enter detailed descriptions of up to 280 characters for fast payments.Bug fixes:• When logging in with Fingerprint, customers were also being asked for their password or passcode.• When updating a mobile number or email address, the app was sometimes crashing.

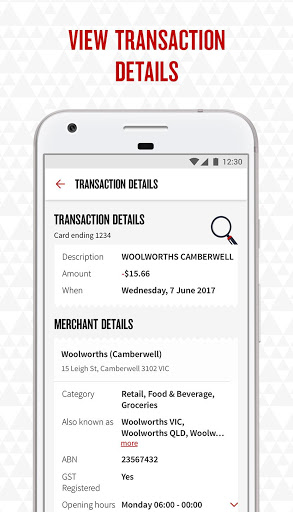

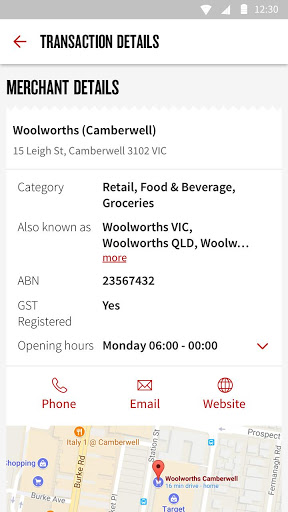

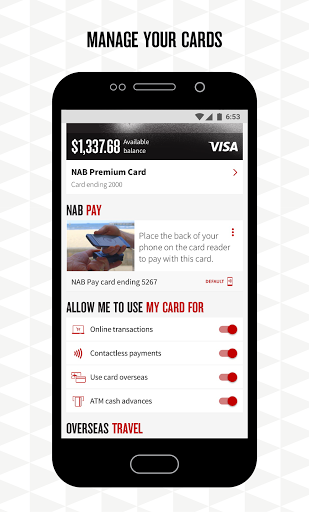

• View information about where, when and who you used your card with• Opt in to register your card to receive push notifications for all approved or declined card transactionsBug fixes:• Improved stability which caused some customers to experience crashes (due to accessibility conflicts and multi-users profiles)• Updating your Account Nickname from the My Cards area did not reflect in some other areas of the app.

Bug fixes:• Some customers were experiencing crashes after launching the app.• Some customers were sometimes taken to the Payment Details screen when tapping the Filter button on the Transaction History screen.• Accessibility issue with TalkBack on the Account Summary screen.

• More detailed information about fee and interest charges from your Transaction History.• View merchant detail for commercial card transactions.• Authorise NAB pay payments with your fingerprint.• Bug fixes:– Accessibility fixes on the Transaction History screen for large text and talkback focus issues.– Better memory management which sometimes caused the app to crash on the Receipt Screen.

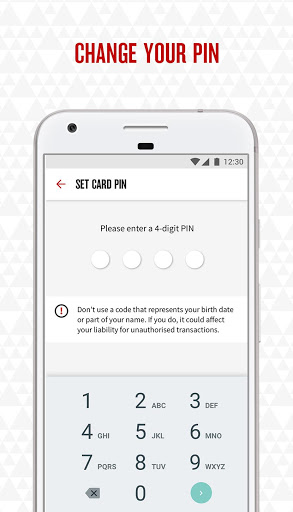

• Activate new debit cards (and set up a PIN)• Change your PIN for your debit cards• Create (or change) nicknames for your accounts• Bug fixes:- Transaction History - fixed first item's amount sometimes not displaying when filters are applied- Accessibility - fixed truncated menu items when large text is being used- Overseas Travel Notifications – improving pop-up messages

• View merchant details for credit card transactions.• Feature enhancements – find us, transaction history, travel tools and offset accounts.• Performance improvements.• Bug fixes - overseas travel notifications.

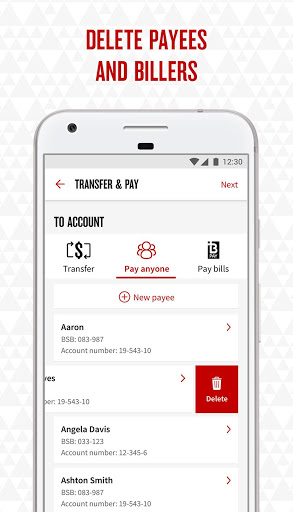

• Delete payees - now you can remove payees that you no longer need, or whose details are out of date so you can keep your payee list nice and tidy.• Travel tools - a handy foreign exchange calculator, and other useful tools to help you manage your spending when you’re overseas.• A few bug fixes, accessibility improvements and generally annoying things sorted.